[1/3] Product De-Risking: A Complete Guide to Understanding and Eliminating Risks - The 4 Main Risks

The success of a product depends on four key risks: value, usability, feasibility, and viability. If these are not managed, product development can fail. Let’s take a look at how to address them.

The article will focus on looking at products, e-commerce, or business in general from the less obvious side — the side of risks, blind spots, threats, and their mitigation.

Most people approach risk in the wrong way:

They either largely ignore it because they subconsciously fear that reality might shatter their dream.

They look at risk very superficially and fail to analyze it in depth.

They lack a system or do not understand how to approach it.

They view it as something negative, something to be wary of.

However, risk is precisely what can help you discover the best opportunities for improvement or for doing things differently.

This is essentially how the entire consulting industry operates. Why do you bring consultants into your company when you already have a vision?

It’s to show you the steps that will bring you closer to your vision while also pointing out the risks you need to be cautious of along the way.

Cybersecurity experts, lawyers, regulatory specialists, risk management financial managers, operators, and many others are, at their core, risk mitigators.

“I genuinely believe being an entrepreneur is being a firefighter” - GaryVee

Part of your personality should have a built-in risk mitigator. The higher you climb in your position, the more time you’ll spend focusing on risk and managing it.

One of the main reasons people hold high positions? Because they’ve been burned so many times that they know what not to do — they call it intuition.

This ties well with one of my favorite quotes: “No one ever got fired for buying IBM.”

When you identify risks, you have several main options to address them:

Temporarily avoid them but continue to monitor the situation.

Work to eliminate them.

Create your own solutions that not only address these risks but also open up new opportunities.

Hire a consultant, like me, to point out the risks, help address them, or oversee the process.

“All I want to know is where I'm going to die, so I'll never go there.” ― Charles T. Munger, Life Is Short And So Is This Book

This is how my mind works and also how a part of my personality operates — I always see potential threats, risks, or problems that might arise. So I thought, why not make a living out of it?

Part of my work, especially when crafting proposals and closing deals, involves quickly identifying potential risks associated with building a product. It’s equally important to determine what actions need to be taken and what unknown variables we need to address early on to improve the product’s chances of success.

This is a major focus of my product consulting. It’s also true for my other role as an operator in our hedge fund, where I often tell founders:

“Your job is to know where we’re going and focus on success. Mine is to ensure we don’t fail along the way.”

And here’s another quote from one of my favorite mentor:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” – Charlie Munger

I may have gone a bit overboard with the quotes, but this is one of my favorite topics 🙊.

Summary of individual risks

Imagine your business, project, or anything else as a castle. Without these components, it’s just a lonely castle with no protection.

Essentially, anyone can easily attack it. Each part of this article focuses on a different level of protection or support. Our task is to build a castle that is fully secured and self-sufficient.

Here are the individual parts we will examine in detail:

The 4 Main Risks

These represent the foundational towers of your castle, providing critical defense against the most significant threats:

1. Value Risk: The danger that your product or service doesn’t meet customer needs or solve their problems.

2. Usability Risk: The risk that your product isn’t intuitive or user-friendly.

3. Viability Risk: The risk that your business model isn’t sustainable.

4. Feasibility Risk: The risk that your team or technology can’t deliver the product as envisioned.

These four risks form the primary fortifications of your castle. Addressing them ensures your defenses are strong against the biggest threats.

Additional Risks and Blind Spots

Beyond the main towers, there are other vulnerabilities that can expose your castle to harm:

• Founder Risk: Misalignment or inefficiencies in leadership.

• Competition Risk: Being outmaneuvered or surpassed by competitors.

• Timing Risk: Launching at the wrong time, either too early or too late.

• Marketing Risk: Failing to effectively communicate your value proposition.

• Distribution Risk: Challenges in reaching your customers effectively.

• Recruitment Risk: Struggles to hire the right talent.

• Location Risk: Choosing a suboptimal market or geographic area.

Unconventional Methods for Identifying Risk

Sometimes, traditional approaches aren’t enough. Here are some creative techniques to uncover potential threats:

1. Smoke Test: Simulate demand with minimal effort, such as using a basic landing page.

2. Human Service: Test your product concept by manually simulating its functionality.

3. Pre-Mortem: Imagine the project has already failed and brainstorm why it happened.

4. War Gaming: Role-play competitive scenarios to identify vulnerabilities.

5. Devil’s Advocate: Challenge every assumption with a critical mindset.

6. Issue Log: Maintain a live document of potential problems.

7. Feature Voting: Let stakeholders prioritize features by importance.

For those who would like to support this effort, you can find the entire analysis here for the symbolic price of one coffee:)

Credit definitely goes to Aakash from the blog Product Growth, which is one of my favorites, and from whose post “How to identify and validate product risk” I drew much of my inspiration.

For those who don’t have much time, here is an overview of each part of the section along with a summary:

1) 4 Main Risks

The foundation of this first article is the 4 main risks, as outlined by Marty Cagan in his book Inspired. I highly recommend this book to everyone.

However, we’ll go much deeper and also focus on the key questions that need to be asked when identifying risks. We’ll also look at methods we can use to mitigate them.

To maintain the metaphor, these 4 risks are like the 4 main towers surrounding a castle.

Thanks to them, you can very effectively identify the biggest threats, and they also provide sufficient protection, especially against the most significant dangers.

So let’s look at how to secure these four towers.

A) Value Risk

Explanation

Value risk represents the potential danger that a product or service will not meet customer needs or solve their real problems, leading to poor market adoption.

This risk can arise from various factors, including misaligned product features, incorrect pricing strategies, or insufficient understanding of customer problems.

The Difference Between This and Other Risks

Other risks can still be pivoted (go a different direction) or salvaged, but if you fail in this, it’s probably the end.

Do you remember the $900 million failure of Google Glass, which failed to demonstrate a broad value for the product and was overshadowed by privacy concerns and many other issues?

Or do you remember Juicero? They developed a $400 Wi-Fi-enabled juicer, but it soon became clear that their value proposition was not strong enough. Customers discovered that they could simply squeeze juice out of the packets by hand, rendering the device unnecessary. It was a harsh lesson in value risk—and, in my opinion, also a failure of adequate testing.

Data speaks volumes. According to a study conducted by CB Insights, 35% of startups fail because they don’t find a market need. This is the second most common reason for startup failure.

Examples from the World

Examples from the world show that even the best can fall victim to these situations.

Here’s a remarkable case study of the startup Zume, whose proposition was essentially mobile pizzerias. This company also ended up in the startup graveyard after its valuation peaked at $2.6 billion. Eventually, it became evident that cooking pizza in a delivery truck wasn’t as easy as it seemed, and customers preferred taste and quality over speed. Who would have thought?

Microsoft Zune failed to capture the market because it didn’t offer significant advantages over Apple’s iPod, which dominated the space. Its value proposition was unclear, and the product failed to resonate with consumers.

Segway was touted as a revolutionary mode of transportation but failed to address a clear problem for the general public. Issues like high costs and regulatory challenges limited its adoption.

Kodak, once a giant in photography, failed to transition effectively to digital photography. The company underestimated the value proposition of digital technology and clung to its traditional film products for too long.

These examples show that there are plenty of ways to fail by misidentifying value.

De-risking Value Risk

Mitigating this risk can be approached in two ways:

Asking the right questions and answering them in detail.

Using various methods to help identify and reduce this risk.

i. Questions for Identifying Risk

Who is the target customer?

Understanding the demographics, behavior, and problems of your target audience is key. Who exactly are you developing your product for?

What problem does the product solve?

Clearly identify the problem your product addresses. Is this a significant problem for your target audience?

How does the product improve the customer’s life?

Does your product offer substantial improvement compared to existing solutions? How does it add value?

Why would customers choose your product over the competition?

What sets your product apart? Is it more cost-effective, easier to use, or more reliable?

What are the potential barriers to adoption?

Consider factors such as price, complexity, required behavior changes, or cultural resistance that may hinder adoption.

How have you validated your assumptions?

What methods have you used to confirm that your product meets a real need? Have you conducted surveys, interviews, or prototype testing?

What feedback have you received from potential users?

What have early users or test groups said about your product? Are there recurring concerns or suggestions?

How will you measure success?

Define the key performance indicators (KPIs) that will help you measure whether the product delivers value to customers.

What are the costs of failure?

What are the financial, reputational, and opportunity costs if the product fails?

Do you have a plan for iteration and improvement?

How will you collect ongoing feedback and iterate on your product to better meet customer needs?

Attempt to answer these questions, either in your mind or by writing them down. By doing so, you will have a clearer understanding of the potential risks and be better equipped to address them.

ii. Methods for Identification

Step 1: Quantitative and Qualitative Analysis

To verify whether you’re solving the right problem, start by asking people. This is the first step, and ignoring or skipping it is a massive “red flag.”

This can be done in two primary ways:

Qualitative Analysis: Customer Interviews

Sit down with your potential customers, ask them questions, and deeply understand their problems. However, make sure the person you’re speaking with is genuinely your ideal customer.

You can ensure this by creating a list of criteria for selecting participants.

There’s no fixed rule on how many people to “interview,” as it depends on what you’re addressing. Generally:

Talking to 8-10 people will give you a basic understanding of the problem.

Around 18 people will provide insights into potential solutions and approaches to address the problem.

A good rule of thumb: When the issues or problems that customers mention begin to repeat, and you’re not learning anything new to form new hypotheses, it’s time to pause this research.

Quantitative Analysis: Market Surveys

Create a questionnaire with questions that address the hypotheses you’ve developed in the previous phase.

The length will depend on the problem you’re solving or the number of hypotheses you’re trying to address. As a general rule, keep it simple to motivate customers to complete it.

Be thorough. A good target is 60-100 fully completed surveys.

Optionally, test various survey formats before fully launching it.

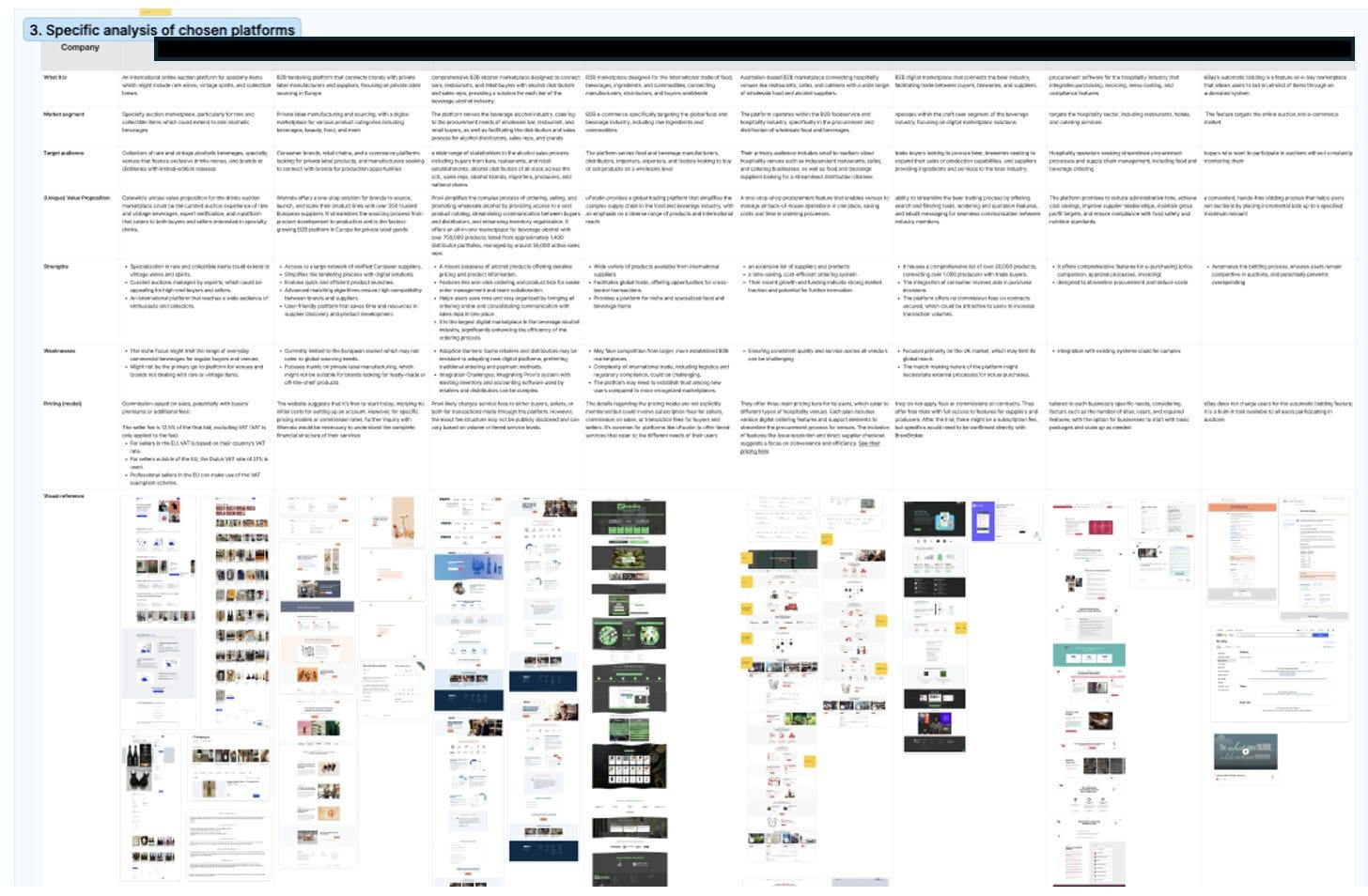

Step 2: Market and Competitive Analysis

Before differentiating yourself, it’s crucial to understand your position, the position of your competitors, and the key factors that can set you apart. Only then can you move toward differentiation.

Over-differentiation from competitors, to the extent of creating your own market, is not only extremely challenging but also highly inefficient, especially in the early stages. If people can’t categorize you, they won’t allocate their budget to you.

Analyze and Compare Competitors

Before differentiating yourself, it’s crucial to understand your position, the position of your competitors, and the key factors that can set you apart. Only then can you move toward differentiation.

Over-differentiation from competitors, to the extent of creating your own market, is not only extremely challenging but also highly inefficient, especially in the early stages. If people can’t categorize you, they won’t allocate their budget to you.

Start with a competitor analysis. Focus on aspects such as:

Who/what they are,

Market segment,

Target audience,

USP (Unique Value Proposition),

Strengths,

Weaknesses,

Pricing model,

Visual references.

Develop a Positioning Map

Create your own metrics and define your own niche, but ensure it’s based on a feasible vision and relevant market indicators that matter to people.

Avoid placing yourself in a category that, while unique, is irrelevant to your audience.

You can approach this by creating a very general positioning like this:

Alternatively, focus on detailed differentiation in highly saturated markets, as I did during product research for one of my clients.

While this map may not fully capture all nuances—since many companies span multiple areas—it serves its purpose of visualizing where you aim to position yourself.

Exercise: “Competitive Factors” or “Strategic Canvas”

This method, from the authors of Blue Ocean Strategy, provides a visual representation of your position relative to competitors and highlights future potential or areas for focus. Templates and more details about this method can be found here.

Toto cvičenie vám poskytne vizuálne znázornenie vášho postavenia voči konkurencii a znázornenie vášho budúceho potenciálu či oblastí, na ktoré by ste sa mali sústrediť.

Purpose of the Exercise:

Illustrates the current market state: Shows the key competitive factors, areas for investment, and what buyers gain, creating a comprehensive strategic profile of the major players.

Encourages action: Shifts focus from competitors to alternatives and from current customers to non-customers.

Visualizes competitive advantage: Helps identify how you can outperform competitors in specific areas.

For example, a strategic canvas for the iPhone in the early 2000s showcased the state of the mobile phone industry, highlighting how Apple’s value proposition differed from competitors. The horizontal axis displayed key competitive factors, and the canvas revealed Apple’s unique positioning.

Step 3: Define the Right Positioning

Defining the correct positioning for your startup or product involves clearly identifying and communicating how it uniquely meets the needs of your target market and differentiates itself from competitors.

This is crucial because it helps potential customers understand the specific benefits and value your product offers, creating a compelling reason for them to choose it over alternatives.

A well-defined positioning strategy ensures that your product resonates with the right audience, increases demand, and ultimately supports sustainable business growth.

I recommend reading Positioning: The Battle for Your Mind, which is considered the best book on the subject of positioning.

Additional areas I recommend developing include USP (Unique Selling Proposition) and Differentiation.

USP (Unique selling proposition)

Write a distinctive feature or benefit that sets the product or service apart from the competition.

Clearly communicate what makes the product unique and why customers should choose it over other options. A USP (Unique Selling Proposition) is crucial in marketing and brand building because it helps attract and retain customers by emphasizing the unique value the product offers.

A strong USP not only differentiates the product in a crowded market but also helps build customer loyalty and support sustainable business growth.

Differentiation via Niche Focus:

Select a narrow area that sufficiently differentiates you from competitors, has demand, and where you can dominate. Once identified, focus all efforts on establishing dominance in this niche.

Example: Facebook initially targeted a single university, expanded to more, and gradually took over the world.

Step 4: Customer Segmentation

Identify your customers and group them into different segments. Then, either focus on your ideal customer or develop strategies to address each customer group individually.

In one of my articles, I’ve outlined a quick approach to customer segmentation in e-commerce.

Step 5: Validate Value Through Traction

Before fully developing your product, test your proposition to ensure it’s on the right track. Here are methods to save money while validating value:

Here are several methods that can save you a lot of money:

Solution Interviews: Conduct detailed interviews with potential customers, discussing your solution to determine if they would be willing to sign a preliminary interest agreement. This means that if you deliver what you’re presenting, they are willing to buy or use it. When people feel they need to make some form of commitment, you can gauge how strong your value proposition is.

Surveys with App Mockups: Create a few potential visuals of your product, such as app screens, and prepare a survey where participants share their thoughts about them. There are several platforms available to facilitate this.

Surveys with Video Feedback: Create a promotional video for your product and run a campaign to promote it. This will reveal initial interest from a broader audience.

Simple Clickable Prototype: Develop a simple clickable prototype and test it live with users. (More details on this in the next section on De-risking Usability).

Fake Doors: Create a basic landing page that describes your product and includes a button for signing up or downloading. When users click the button, display a message saying the product is still in testing and invite them to leave their email to be notified upon release.

Wizard of Oz: Build a simple functional prototype and advertise a specific feature, such as automatic invoice scanning using AI to fill out bank orders. If users request the feature, perform the tasks manually. If there is high demand, begin automating the process.

Simple Product via Low-Code Platforms: Use modern platforms to create a prototype that may not look perfect but is functional. You can test this prototype with real users within a week.

Step 5: MVP (Minimum Viable Product) with Clearly Defined KPIs (Key Performance Indicators)

Once you’ve completed all the previous steps, it’s time to build your MVP. The MVP should include all the essential key features, but nothing extra.

An MVP allows you to quickly and objectively measure genuine customer interest in your product.

For this purpose, define the metrics you’ll measure, which will indicate whether you’re on the right track.

Here are a few key metrics to focus on:

Activation Rate Post-Download or Onboarding: Measure whether users who download your app or complete onboarding start actively using it.

Session Frequency (Weekly or Monthly): Track how often users open the app within a given period and how much time they spend on it.

Churn Rate: Analyze the rate at which customers stop returning or discontinue using your product.

Lifetime Value (LTV): This is your North Star metric. How much value does each customer bring over their lifecycle? LTV isn’t just about revenue; it’s a key indicator of long-term engagement. Are your customers staying loyal?

Step 6: Don’t Be Afraid to Pivot

Especially in the early stages, iterations and new features may not suffice. That’s when it’s time to pivot — to change direction when you realize the wind is blowing from another direction.

Pivoting is not a defeat or failure. It’s about identifying what isn’t working and having the courage to change course so you can stay in the game.

1. Instagram (formerly Burbn): Instagram started as a location-based check-in app called Burbn, which also included photo-sharing and event planning features. Founders Kevin Systrom and Mike Krieger noticed that users were primarily using the app to share photos rather than check in at locations. Recognizing this trend, they pivoted to focus solely on photo-sharing. This shift led to the creation of Instagram as we know it today, a massive success acquired by Facebook in 2012 for $1 billion.

2. Slack (formerly Tiny Speck): Slack began as a gaming company called Tiny Speck, which developed an online game called Glitch. Despite its creative design, the game failed to gain sufficient popularity. However, the internal communication tool the team used during development proved highly effective. Recognizing its potential, the team pivoted to focus on this communication tool, which evolved into Slack. Today, Slack is a leading workplace communication platform valued at billions of dollars.

Minimizing value risk is not a task to simply check off your list. It is a continuous, never-ending process. Each day brings new data, new insights, and new opportunities for improvement.

In short, addressing value risk is a journey, not a destination. And you will be on this journey for as long as your product exists.

B) Usability Risk

Example

Usability risk arises when a product is difficult to use, unintuitive, or fails to meet user expectations for simplicity and functionality. This type of risk can significantly hinder product adoption, regardless of its potential value or features.

Ensuring a product’s user-friendliness involves considering the user experience (UX) from the earliest development stages, including aspects such as design, navigation, and overall accessibility.

This is undoubtedly one of my favorite topics.

It’s not about whether people can find the value you’re offering but whether they can access it.

For example, Apple Vision Pro faces a similar problem that led to the failure of the now-defunct Google Glass. The latter didn’t fail because of its value but because people didn’t want to wear such devices in public. Complaints ranged from ridicule and headaches after prolonged use to, of course, privacy concerns.

Value Risk addresses demand, while Usability Risk evaluates whether a user completes the journey from the first interaction with the product to its final use—and does so with a smile.

You can think of Value Risk as the heart of the process, while Usability Risk functions like the arteries, pumping blood from the heart throughout the body to ensure it reaches where it’s needed.

The numbers are clear: Amazon Web Services reports that 88% of online shoppers do not return after a poor user experience. That’s a significant loss of potential revenue.

If you lose users early on due to usability issues, the chance of them coming back is extremely low.

A great product for UX professionals, comparable to Figma for designers or Jira for developers, is Dovetail. I highly recommend checking it out.

Examples from the World

Google Wave was an ambitious project aimed at revolutionizing online communication and collaboration. However, its complex interface and lack of clear guidance led to user confusion. The steep learning curve and usability issues resulted in low adoption rates and ultimately its cancellation.

One of the first social networks, Friendster, failed to retain its user base due to usability problems like slow loading times and frequent technical issues. Poor user experience drove users to more reliable alternatives like MySpace and Facebook.

Quibi, a platform for short mobile videos, struggled with usability issues tied to its unique video format, which could only be viewed on mobile devices in vertical or horizontal modes. The lack of flexibility and user control, coupled with an unintuitive interface, contributed to the platform’s rapid decline.

De-risking Usability Risk

Usability risk can be mitigated in two primary ways:

Asking the right questions and answering them in great detail.

Using various methods to identify and reduce the risk effectively.

Questions for Identifying Usability Risk

Who are the primary users of the product?

Understanding the demographics, technical proficiency, and specific needs of the main users is critical for designing an intuitive user experience.

What are the main tasks users perform with the product?

Identifying the key tasks users need to accomplish helps prioritize features and ensures the most important functionalities are easily accessible and simple to use.

How does the product interface accommodate different skill levels of users?

The product should cater to both beginners and advanced users, striking a balance between simplicity and advanced functionality.

Has usability testing been conducted with real users?

Gathering feedback from actual users through usability testing provides invaluable insights into potential issues and areas for improvement.

Is the product design consistent and intuitive?

Consistency in design elements such as icons, colors, and layouts helps users quickly understand and navigate the product.

Are there clear instructions and support resources available?

Providing guides, tooltips, and help sections can significantly enhance users’ understanding and effective use of the product.

How does the product handle user errors or mistakes?

Ensuring error messages are clear and provide guidance on resolving issues is crucial for a positive user experience.

Is the product accessible to users with disabilities?

Considering accessibility features such as compatibility with screen readers and keyboard navigation ensures the product is usable by a broader audience.

What feedback mechanisms are available for users to report issues?

Allowing users to easily provide feedback on usability problems enables continuous improvement and quick issue resolution.

How often are usability improvements and updates implemented?

Regularly updating the product based on user feedback and usability testing findings helps keep the product user-friendly and relevant.

Methods for Identification

Step 1: Clearly Define What You Want to Achieve

Start by defining your main goal and creating a few hypotheses about how you can achieve it. Additionally, clarify exactly what you want to investigate.

It’s common to encounter clients who either lack a clear definition of what they’re trying to discover or attempt to investigate multiple hypotheses at once.

Your findings should always be measurable or have a direct impact on a specific metric you’re tracking.

Key Tips:

1. Define Desired Outcomes: Clearly outline the desired outcomes for any discovery process—whether continuous or one-off. If you don’t know what decision or action the discovery is meant to support, it’s unlikely to provide valuable insights.

2. Have a Clear Purpose for Results: Knowing what you plan to do with the results before starting ensures that the discovery process delivers the right information.

Source: Doventail: The four deadly sins of continuous discovery

Step 2: Solve the Right User Problem

Ensure that you’re addressing a truly relevant problem for your customers, and be uncompromising in doing so. Set high standards for everything that goes into production.

It’s not enough for people to simply agree with your idea—you need to see strong enthusiasm for it, to the point where it feels indispensable.

“When creating new products, new ways to monetize your product, or new features, the signals should be very strong to pass the test.”

Source: Doventail: The four deadly sins of continuous discovery

Most things fail because people aren’t strict enough when selecting the features that showed genuine interest during testing.

Another critical step is to focus solely on the bare minimum of the most-used features. Many people make the mistake of building new features instead of repeatedly optimizing and improving existing customer journeys. Why? Because creating new features is much more exciting and fun than constant optimization.

However, this is a significant mistake that can ultimately cost you growth opportunities, money, and efficiency.

Every major tech company—including Facebook, Amazon, Netflix, Airbnb, LinkedIn, Uber, TikTok, and—as highlighted in recent newsletters—Duolingo, has long prioritized the optimization of every square inch of their product.

Source: How to accelerate growth by focusing on the features you already have

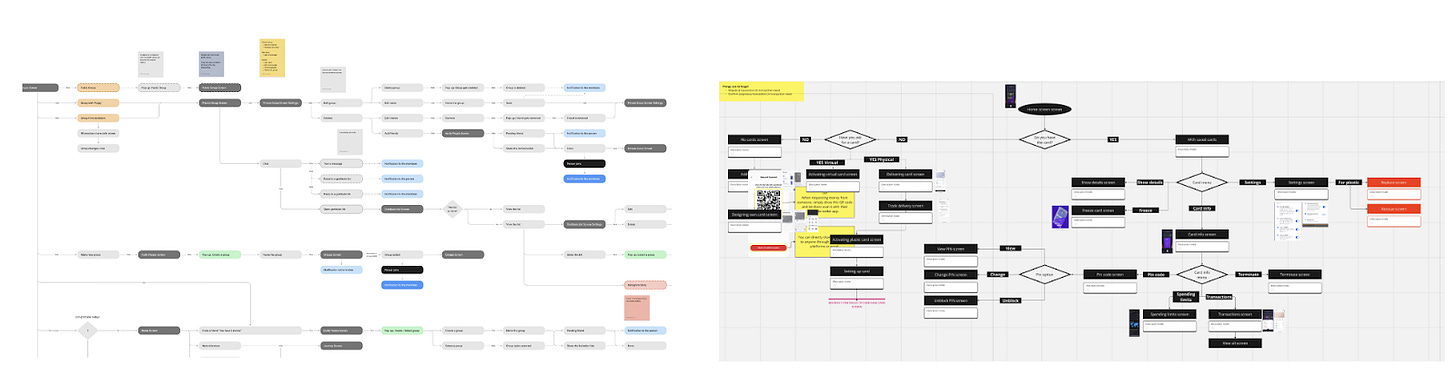

Step 3: User Journeys and Flows

Once you have defined your goals and the hypotheses you want to test, it’s time to map out how your customers will achieve their objectives.

Here are two fundamental approaches you can use:

User Journey Mapping

Visualize the end-to-end experience users have with your product. Identify key touchpoints and pain points to improve their journey.

You can find several examples of user journey maps in this article, but even a basic version is sufficient to start with.

Here is for example something we did:

Design Customer Flows

Create pathways that guide users toward achieving specific goals within your product, ensuring a smooth and intuitive experience.

I aim to share articles, usually as links embedded within sentences, along with examples from my own life—real, sometimes messy examples—because that’s where the real insights lie.

Create a Decision Diagram

What is a Behavioral Decision Diagram?

It’s a tool that illustrates how different steps in a process connect to one another. I go into detail about this in my case study, The Ultimate Guide: A Model for Identifying and Changing Behavior.

A diagram breaks down the process into individual activities, illustrating the relationships between them and the flow of the process.

This flowchart provides a detailed description of how the process unfolds in practice, as well as data on decision-making points, enabling subsequent quantitative analysis.

Why Should You Use a Behavioral Decision Diagram?

The simplicity of a behavioral flowchart makes it useful for creating a shared understanding of processes within teams.

It can be used to identify the choice architecture that is critical for the efficiency and stability of the process.

A decision diagram is essentially the same as drawing user journeys or user flows, but it places greater emphasis on decisions.

Krok 4: Prototype Design

Now that you’ve mapped out the user journeys, it’s time to create a basic prototype that simulates the product’s usage in great detail, ideally using Figma or a similar tool.

This will allow you to observe how people actually interact with it.

In this phase, you and your designer step into the front lines.

The designer creates the designs, and you provide feedback, ensuring everything aligns with the overall vision of the project.

Your role isn’t just to passively watch as the designer works. At the end of the day, it’s your responsibility to approve the designs and ensure they guide the user to the desired outcome while remaining consistent with the other aspects of the product.

Step 5: User Testing and Grouping

This is where reality meets vision—the place where dreams are made or broken.

Create scenarios, plan exactly what you want to test, clearly define what you are trying to achieve, and get started.

After each testing session, select the most important insights, categorize them, and group similar ones together.

This is an example of how I did it—I divided feedback into groups based on whether it was neutral, negative, or positive, who provided it, and what the insight was.

Or, for example, like this:

Step 6: Heatmaps, feedback loops

Now it’s time for analytics. This is where you consult with your data team and designer.

Analytics turn numbers into insights. You then translate those insights into specific actions.

Compare existing data with your assumptions, and if there are any discrepancies, try to identify why.

Your role is to connect analytics with design. You’re the interpreter who translates technical insights into actionable steps.

Step 7: Major Overhaul (Only If Necessary)

Sometimes the data might not confirm what people said during testing, or your hypotheses simply didn’t work out. In such cases, changing direction is the only option.

You, the designer, and the UX researcher need to sit down and have a thorough discussion.

While the final decision is yours, it’s a team decision. Many people fear these decisions because they perceive them as failures.

However, it helps to change your mindset and focus on the ultimate goal: achieving a great user experience, regardless of the path taken to get there.

I once redesigned a short user journey seven times, even though everyone said by the second iteration that it was good enough. But it wasn’t. It’s not always fun, but I learned to see it as a necessary step to achieving great results.

Whether it’s minor tweaks or significant changes, you’re far from the end of the game.

C) Feasibility Risk

Vysvetlenie

Okay, we’ve designed something amazing—great, but can we actually make it happen?

This risk arises when a company hires separate agencies for design and development. Designers often want to impress clients, creating solutions that may excite them but are nearly impossible to implement.

That’s why Elon Musk brings designers and developers into the same room. This approach ensures designers understand how difficult their ideas are to build and helps developers understand why certain designs are essential and their impact on the user.

This type of risk encompasses technical challenges, resource limitations, and logistical issues that can hinder the successful implementation of a product.

Feasibility risk occurs when there are significant doubts about whether a product can be built as planned, with the available technology, within budget, and on time.

Notable Example: Theranos

Theranos, founded by Elizabeth Holmes, had a revolutionary vision for medical testing: conducting numerous tests with a single drop of blood. However, the technology was not sufficiently developed, and the results were neither accurate nor reliable. Internal pressure to meet deadlines led to faulty products. Ultimately, the inability to deliver on promises resulted in the company’s downfall and legal repercussions.

I recommend watching the documentary about this company for more insights.

Other Examples

Better Place aimed to revolutionize the electric vehicle industry with a network of battery-swapping stations. However, the technology wasn’t mature enough, and the large-scale infrastructure required was too costly and complex to implement, leading to the company’s bankruptcy.

De-risking Feasibility Risk

Once again, in this section, we will look at the questions that need to be asked, as well as methods to reduce feasibility risk.

This risk is often where everything falls apart because people don’t want to address it. For my acquaintances, I am essentially a “walking de-risking” person who constantly listens to new ideas and must “test them against reality.”

Questions for Identifying Feasibility Risk

What are the key technical challenges in creating this product?

Identifying and understanding the main technical obstacles is crucial for assessing feasibility.

Do we have the necessary expertise and skills within our team?

Ensuring your team has the required technical knowledge and experience is essential for overcoming feasibility issues.

Is the technology required for this product mature and reliable?

Evaluating whether the technology is ready for use and has a proven track record can help mitigate risks.

What resources (time, money, materials) are required to create this product?

Accurately estimating the needed resources is fundamental to assessing feasibility.

Are there any external dependencies or partnerships?

Understanding reliance on third parties or partners can uncover potential risks.

What are the potential bottlenecks in the development process?

Identifying points in the process that could cause delays or problems helps in planning mitigation strategies.

How do we plan to test and validate the product during development?

A robust testing and validation plan ensures technical issues are identified and addressed in time.

What contingency plans do we have for unexpected challenges?

Having backup plans for unforeseen issues is critical to maintaining project momentum.

What is the development timeline, and is it realistic?

Setting realistic deadlines based on a thorough understanding of the project scope and potential challenges is key.

How will we measure progress and success throughout the project?

Establishing clear metrics and checkpoints allows for continuous feasibility assessment and timely adjustments.

Methods for Identification

Step 1: Initial Study

Look at the problem from two perspectives:

Technical feasibility

Can your project be implemented with the technology you have or the “tech stack” your developers are using? What about scalability? Can it work under different conditions?

Operational feasibility

Can your current team, processes, or organization execute this project? What resources or focus will be diverted from other areas?

If there are open questions or risks that could have a significant impact, don’t hesitate to consult experts. Many people try to save money by avoiding expert advice, but investing in an hour with a specialist who can answer critical questions is often far less expensive than fixing a mistake that could have been prevented.

Step 2: Create Scenarios

Scenario analysis involves creating and evaluating different scenarios based on various assumptions to determine how they impact the feasibility of the project.

Identify all possible scenarios in which a user will interact with the product and explore all potential ways they might use or handle it.

Step 3: Prototype Testing

If everything looks promising and your technical team doesn’t have horrified expressions, move on to rapid product testing.

This isn’t just playing around; it’s real preliminary testing to see if your product can handle the solution you’ve proposed. Can the system manage it? Are there any negative responses?

You don’t need to test everything together; try testing individual components as well. SpaceX tests all systems separately before integrating them.

Step 4: Stress Test

Stress testing involves exposing a system, component, or product to extreme conditions to evaluate its performance and identify potential weaknesses.

In other words, once you create something, try to break it.

This method helps determine the robustness and reliability of the product by simulating scenarios that exceed normal operating capacity, ensuring it can handle unexpected challenges and demands.

Stress testing is essential for identifying critical failure points and making necessary improvements before full-scale deployment.

Step 5: Resource Assessment

If everything has been designed, tested, and approved, the final question remains—do you have enough resources (people, finances, technology, materials, conditions) to implement it or bring it to a state where it makes sense?

If not, do you have a plan in place to acquire everything needed?

Step 6: Drawing Board

Often, things just don’t align—calculations don’t add up, or the technology isn’t ready yet.

At this point, you have two options: either figure out a different path to reach the goal or create a simpler version using what you already have (if it makes sense).

Final Words on Feasibility Risk

Feasibility—or as I call it, the clash with reality—is not a one-time process. It’s something you need to address regularly and always keep in mind.

Whether it’s a lack of resources, technological limitations, or operational challenges, your role is to keep moving forward—changing, adjusting, and redrawing—until you find the right solution or at least the best possible compromise.

C) Viability Risk

Example

The risk, partially addressed in the previous section on feasibility, this time focuses on viability.

This risk pertains to the uncertainty of whether a product can be financially successful and sustainable in the long term. It encompasses various factors, including market demand, cost structure, revenue potential, and scalability.

For product managers, project creators, operators, and innovators, understanding and mitigating viability risk is crucial to ensuring that their product not only meets customer needs but also generates sufficient revenue to sustain and grow the business.

Príklady

WeWork attempted to revolutionize commercial real estate by providing shared workspaces but faced significant viability risk. The company signed long-term leases and subleased spaces, resulting in high financial commitments and substantial expenses. At its peak, the company was valued at $47 billion. Overestimating demand and failing to achieve necessary occupancy rates, combined with unsustainable business practices, led to massive losses. A failed IPO in 2019 exposed these issues, resulting in a dramatic drop in valuation and extensive restructuring. This highlights the importance of realistic financial planning and managing operational costs to ensure viability.

Another notable example of a company that failed to manage viability risk effectively is Pets.com, launched in 1998 with the aim of becoming a leader in online pet supplies retail. Despite significant investments and a high-profile marketing campaign, including the famous “sock puppet” mascot, the company struggled with its business model. Pets.com faced high shipping costs, low profit margins, and intense competition from traditional brick-and-mortar stores. Moreover, they overestimated market demand for online pet supply shopping at the time. By 2000, just two years after its launch, Pets.com ran out of funds and was forced to shut down, underscoring the importance of addressing viability risk from the outset.

De-risking Viability Risk

If I had to address viability risk with just one question, it would probably be: Does this all make sense?

Questions for Identifying Viability Risk

Is there sufficient market demand for our product?

Conduct thorough market research to ensure there is a real need for your product and that the market size is substantial.

What is our target audience’s willingness to pay?

Assess how much potential customers are willing to spend on your product to ensure your pricing strategy aligns with their expectations and budgets. Here is the methodology of how to do it.

What are the cost structures associated with producing and delivering our product?

Analyze all costs related to production, marketing, distribution, and operations to ensure sustainability.

What is our break-even point?

Determine the number of units you need to sell to cover all costs and start generating profit.

Who are our main competitors, and what are their strengths and weaknesses?

Conduct a competitive analysis to understand your competitors’ market position and identify opportunities for differentiation.

What is our unique value proposition?

Clearly define what sets your product apart from competitors and why customers should choose it.

What revenue streams can we develop?

Explore different revenue models, such as subscriptions, licensing, or one-time sales, to diversify income sources.

How scalable is our business model?

Evaluate whether your business can grow without a significant increase in costs and identify potential scalability obstacles.

What are the potential risks, and how can we mitigate them?

Identify financial, operational, and market risks and develop strategies to minimize their impact.

Do we have a realistic financial forecast?

Create detailed financial projections based on realistic assumptions about costs, revenue growth, and market conditions.

Methods for Identification

Step 1: Strategy

Start from the top-level view. Choosing the right strategy is critical as everything else—absolutely everything—flows from it.

Below are two approaches that might help you define the path you want to take:

7-powers

The book 7 Powers: The Foundations of Business Strategy by Hamilton Helmer outlines seven fundamental sources of enduring competitive advantage that businesses can leverage for long-term success:

Scale Economies: Cost advantages as production increases.

Network Economies: The value of a product or service increases with the number of users.

Counter-Positioning: A new entrant adopts a superior business model that incumbents cannot easily replicate.

Switching Costs: Barriers that make it hard for customers to switch to competitors.

Branding: The ability to command customer loyalty and preference.

Cornered Resource: Exclusive access to valuable resources.

Processing Power: Operational advantages achieved through superior processes.

These “powers” can guide you in creating and maintaining a significant competitive edge in your industry.

Rather than just using these to dominate a market, you can also see them as your “North Star,” directing you on where to go and what obstacles to overcome.

I recommend exploring this further; this brief overview is just a starting point.

Define Your MOAT

A MOAT, as Warren Buffet often refers to, represents a company’s or product’s competitive advantage that protects it from competitors and enables long-term profitability.

Much like a moat around a castle kept invaders out in medieval times, a business MOAT shields a company from competitors by creating barriers such as a strong brand, cost advantages, network effects, or unique products.

For example, a patent is one of the strongest forms of a MOAT.

This ties directly to the previous section. Identify and select the key area in which your company will not only dominate but also create something others cannot easily replicate.

Step 2: Business Model

After defining your strategy, you should consider whether it makes sense.

Does this strategy, product, or innovation fit into the overall business model of the company?

How will you generate revenue? Subscriptions, ads, freemium model? Is it attractive enough to cover costs?

Will your new product cannibalize customers from your existing ones? Is there sufficient market interest in this product? Have you mapped out the competition? What value will it actually bring to customers?

There are plenty of guides online on how to create a business model.

Finally, make sure to validate this model with all relevant stakeholders in your company who will be affected by it, as well as with upper management.

Step 3: Regulations

Regulations—an area that everyone is “excited” about. From my perspective, it’s the most boring yet the most important aspect.

You can have everything else we’ve discussed in place, but if regulations don’t allow it, it’s the end—without any competition. Of course, unless you’re operating on the assumption that the situation will change in the future, but that’s a completely different story.

Every field has its laws, rules, and obligations. Navigating them is a kind of art, and in this case, ignorance is no excuse.

Step 4: Financial model

A financial model is not just about numbers; it tells the story of your company if you know how to interpret it.

Start with costs. These should be calculated in great detail, including both fixed costs, which represent what you need to pay to reach your goal, and variable costs, which are usually directly or indirectly tied to revenue.

Next, move on to revenue—identifying all the ways the company will generate income. This is more about recognizing potential revenue streams than precisely estimating figures, as exact predictions are often impossible.

Then, create various scenarios, such as a negative scenario, the most likely scenario, and a positive scenario.

From these, you can calculate ROI (Return on Investment). If the ROI doesn’t work out, revisit the business model until it makes sense.

For those interested in different types of financial models, I highly recommend looking at templates from SlideBeam.

If the way I approach things resonates — or if your product, idea, or strategy feels even slightly “off” — I might be able to help.

Let’s have a quick 20-minute call to find clarity together:

Conclusion

That’s it for a detailed breakdown of the main risks and ways to address them.

In the next article, we’ll explore another group of important risks you’ll face and should keep on your radar.

See you in the next article.

- Peter